Workers Compensation Clarity

THE PROBLEM: Your agent probably told you there are only two rates for you to track, one for the office and one for the field. A large part of that is because they know contractors don’t have an accurate way to track all the codes and rates properly, so it is just easier to put all your field people in one high rate and call it done.

Come audit time, they ask for your W-2’s, do the calculation on the gross payroll. Request your subs 1099’s and if you don’t have a certificate of insurance (COI) for each, they will calculate them as employees in that same high rate, and you get the final bill. This means you will pay the highest class code for all your work, including your subs. This is the default method, and easiest for your agent and the carrier (and how they make the most money). Surprise, we finished your audit and here is your new bill, has this ever happened to you?

Work Comp Can Vary By State

Details Below

Determining Your Cost

As a contractor doing new construction, additions, and/or remodeling, your primary workers compensation code will be Carpentry 5645, which states (some states like CA may be slightly different):

“This phraseology includes all carpentry work in connection with the construction of residential dwellings when performed by employees of the same carpentry contractor or general contractor responsible for the entire construction project.”

Carpentry Work:

- all interior wood trim

- all types of roofing materials

- cabinet installation

- construction of the sill

- decking

- detached structures

- doors

- fencing

- finished flooring

- lathing

- rafters

- roof deck

- rough floor

- rough framework

- sidewall sheathing

- siding

- stairs

- wallboard installation

- windows

- wood or light-gauge steel joists, and

- wood or light-gauge steel studs.

However, any work other than what is listed above, can be tracked as a separate code/rate/cost to you as a contractor.

Subs & Contract Labor (1099)

One of the contractors’ biggest mistakes is not realizing the subtle difference between a subcontractor and 1099; here is a simplified explanation. Federal and individual states may have additional rules which do not apply to this topic.

Contract labor, or 1099, is someone you provide straight pay. They don’t have insurance, and you may hire them as day labor, or longer term. Since they don’t have insurance, you have the privilege of paying the work comp for them.

A Subcontractor (often confused with the 1099), or independent contractor, is a business that has their own insurance. However, if you do not get their Certificate of Insurance and keep it on file, come audit time, you guessed it, you will pay their comp.

Do you have the right workers comp agent?

Are they just giving you two codes/rates, or are they working with you to track all the possible codes/rates?

Cost Cutting Methods w/Subs & 1099's

Subcontractors should have their own work comp insurance, and you should have a “Certificate of Insurance” from them, known as a COI. Additionally, we recommend their General Liability Insurance should name you and your client(s) as “Additionally Insured” on the COI. This provides you with additional protections; please ask your agent. A one-man show can sometimes opt out of work comp with a general liability policy and qualify as a sub, but check with your agent and policy.

Subcontractors who do not have insurance will be treated as employees (according to your insurance policy). This means you will have to pay workers compensation for all the money paid to them, which will include material cost and overhead if you do not have documentation about what portion of the job price represented payroll.

Please make sure the proper code is applied for their work: Plumbing, HVAC, Electrical, etc., which may be much lower. This can drastically affect your audit and the cost you pay.

Track Codes/Rates Properly w/Mecherath

You should separately track all of your work, which is not 5645 Carpentry. If your work is not in the carpentry code description (shown above), tracked by its own code, it should be less expensive.

Some projects may not need to be in the 5645 Carpentry code. A kitchen remodel and finishing a room with non-structural framing and drywall are both less expensive codes (see below for examples). We have seen those two codes in some states differ as much as $20.00/100 of payroll, which adds up fast. Mecherath tracks all of this, and this is what you show in your audit report created by Mecherath.

Additional Codes You May Want To Track

Excavation

6217 Digging/Excavation/Backfill.

Many contractors (especially Concrete) have their own equipment (additions, etc.) to do excavations for flatwork or crawlspace additions, this is a separate cost code.

Concrete

Concrete has three primary codes:

5221 Flat work and spancrete

5213 Foundations and Walls

5215 New Construction, residential only

5215 New Construction is for “residential only” at the same project site. If you are do an addition, it is not considered new construction. Thus the walls and foundation is 5213, and the flat work is 5221. You should track these different codes.

Roofing

5551 Roofing – All kinds & drivers

5538 Metal Building Erection – Prefabricated, Including Roofing & Drivers

5551 Roofing now includes all roofing whether is is residential or commercial, flat or pitched.

9534 Many roofing contractors have their own (mobile) crane, if that operator is not performing any roofing work, then it is a separate rate

Demolition

5403 NOC (Not Otherwise Classified) Demolition

If you are doing Demolition, it may be the highest rate for the entire project. We have seen companies hire another company just to do their demo work as a sub, to keep the balance of their rates lower on a project. Contracting demo as a different project within your own company, may be a bit less justifiable if you are still doing the rest of the project.

Office

8810 Office – Clerical Office Employees (no field work)

Windows and Doors

5102 Windows and Doors

This is a separate code and applies only to exterior doors, but not overhead garage doors. When not doing other Carpentry 5645

Pools

5223 Pools, applies to the construction of all types of pools, be they municipal, commercial or residential nature. Contemplates in ground and above ground pools.

6217 Digging/Excavation/Backfill

5069 Iron or Steel (side panels)

9014 Maintenance

3724 Plumbing (Commercial Pumps)

5183 Plumbing – Plumbing NOC (Not Otherwise Classified)

Flooring

5478 Floor Covering Installation – Applies to the installation of resilient flooring, including tiles and sheets made of vinyl, linoleum, asphalt or rubber.

5349 For ceramic tile, mosaic and indoor stone

5437 For the installation of wood flooring requiring a great deal of finish work (i.e. 3/4 x 2-1/4 raw wood)

0042 For installation of artificial turf to replace natural turf in places such as parks or athletic fields.

Renovate, Repair, and Paint Rule (RRP)

While this is not a workers compensation code (it would fall under 5403 Demo), we would like to make you aware of the risk exposure. Please see Mecherath’s RRP Video documentation process.

Sheetrock

5445 Wallboard, Sheetrock, Drywall, Plasterboard, or Cement Board Installation – Within Buildings and Drivers

Description: Applies to the installation of wallboard, sheetrock, drywall, plasterboard or cement board in private or commercial residences. Includes drywall framing, the taping of seams or joints, application of joint compound and sanding as well as installation of light gauge steel by wallboard installation contractors or specialty contractors.

NOTE: If you are only framing, drywall, and finishing, you can use the code 5445 (Think finished basement/garage/etc. If you are performing other carpentry this will fall under the Carpentry Code 5645.

5020 Acoustical Ceilings would be a separate code in this scenario.

Ceiling Installation

5020 Ceiling Installation – Suspended Acoustical Grid Type

If you are doing this while doing other 5645 Carpentry work, this may not apply.

Electrical

5190 Electrical wiring – Within buildings and drivers.

Electric is a separate cost code. Many states or municipalities require an electric license. Check your local codes requirements, the auditor might.

See Excavation.

Plumbing

5183 Plumbing – Plumbing NOC (Not Otherwise Classified) and drivers.

Plumbing is a separate cost code. Many states or municipalities require an plumbing license. Check your local codes requirements, the auditor might.

See Excavation.

California

Not surprising, California has their own code system, and some different rules.

California has something they call “Duel Wages.” For some codes, if the employee earns over a defined pay rate, their comp rate is lower. This does not apply to all codes, just the Duel Wage Classifications. Here is the link to WVIRB.com/Duel_Wage_List.

Primarily, these Duel Wage codes are for us in the trades. At some point, it may make sense to pay the employee just a bit more to lower the comp rate.

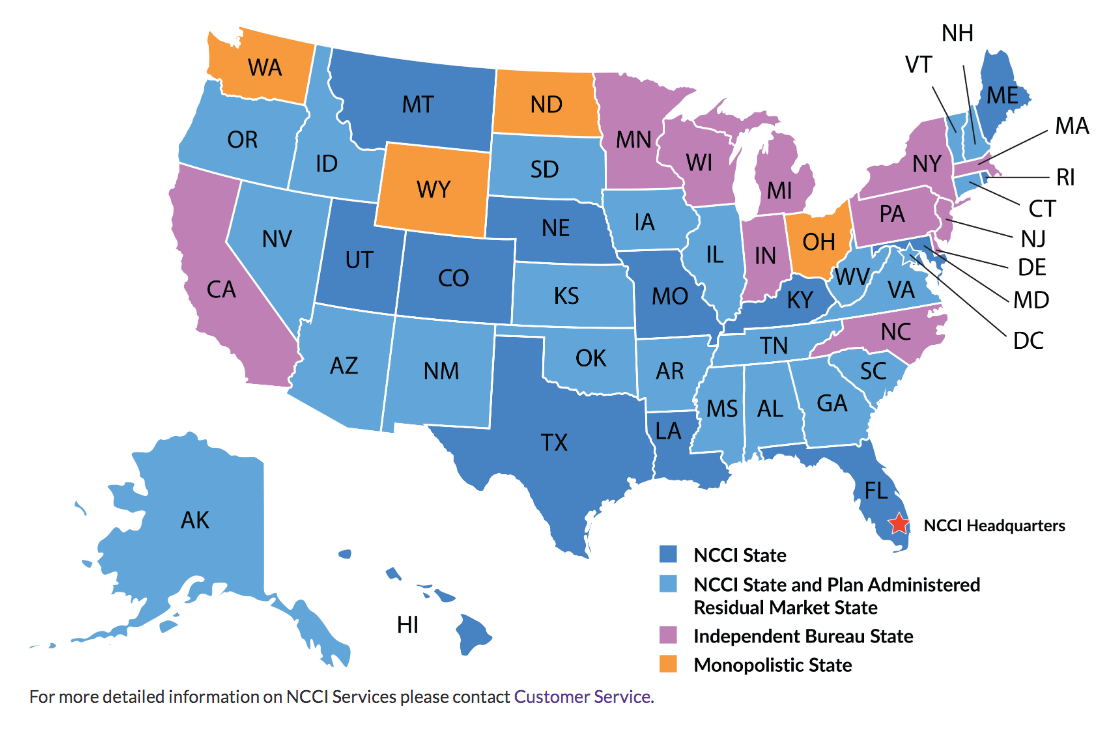

Multiple States Workers Comp

Each state can have its own set of rules/codes/costs for the same work; check with your agent.

Working in a neighboring state may require a rider or a separate policy, requiring separate tracking for each code/rate. Mecherath handles this with ease. When you set up your work category, put the state (MI, MA, CA, FL) in front of the work category: FL-Carpentry Frame, FL-Trim Carpentry, GA-Trim Carpentry, TN-Carpentry Frame, etc., and set up the correct code and rate for each.

Mecherath breaks this out on the Workers Compensation Report separately, making your audit simple.

Useful Links

Each link will open a new window tab, providing you with additional information.

Work Comp Laws by State

What each state requires for workers compensation.

Worker Comp Audit Information

Did you get an unexpected result from your audit?

NCCI

Sets the Codes and Standards

Administrative

Each States Admin Office Contact

This is the list of each state’s Administrative Organization and contact information.

WCIRB

California Codes and Standards

WCIRB

Duel Wage Codes and Definitions

California has some codes which have duel wages, here is the list. Higher pay, lower comp.

Audit Prep

What you can do about your work comp

Institute of WorkComp Professionals is geared toward insurance agents. But as contractors we can learn a lot too! Their blog.

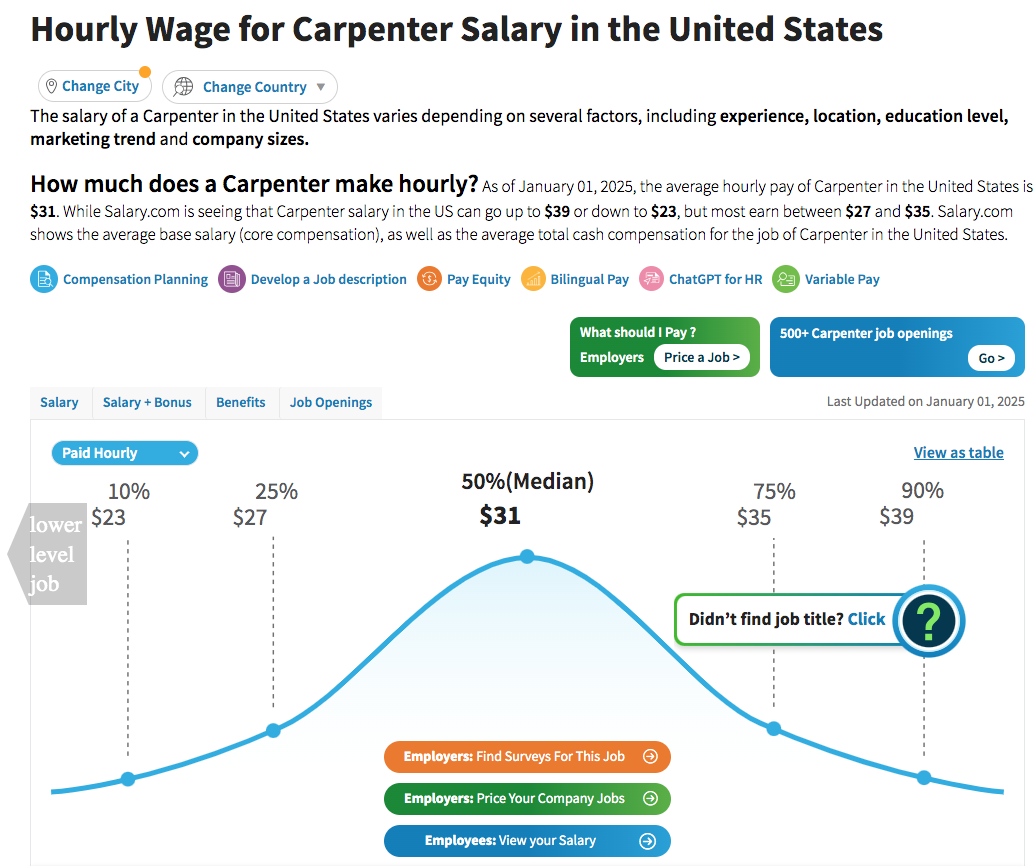

Nat. Wage Ave.

Site to search national wage averages

Audit Prep

Comp is not comp, not all the same

Institute of WorkComp Professionals has loads of information what to do if you have a claim to keep your cost down, and stay in control

Calculating Your W.C. Cost/Savings

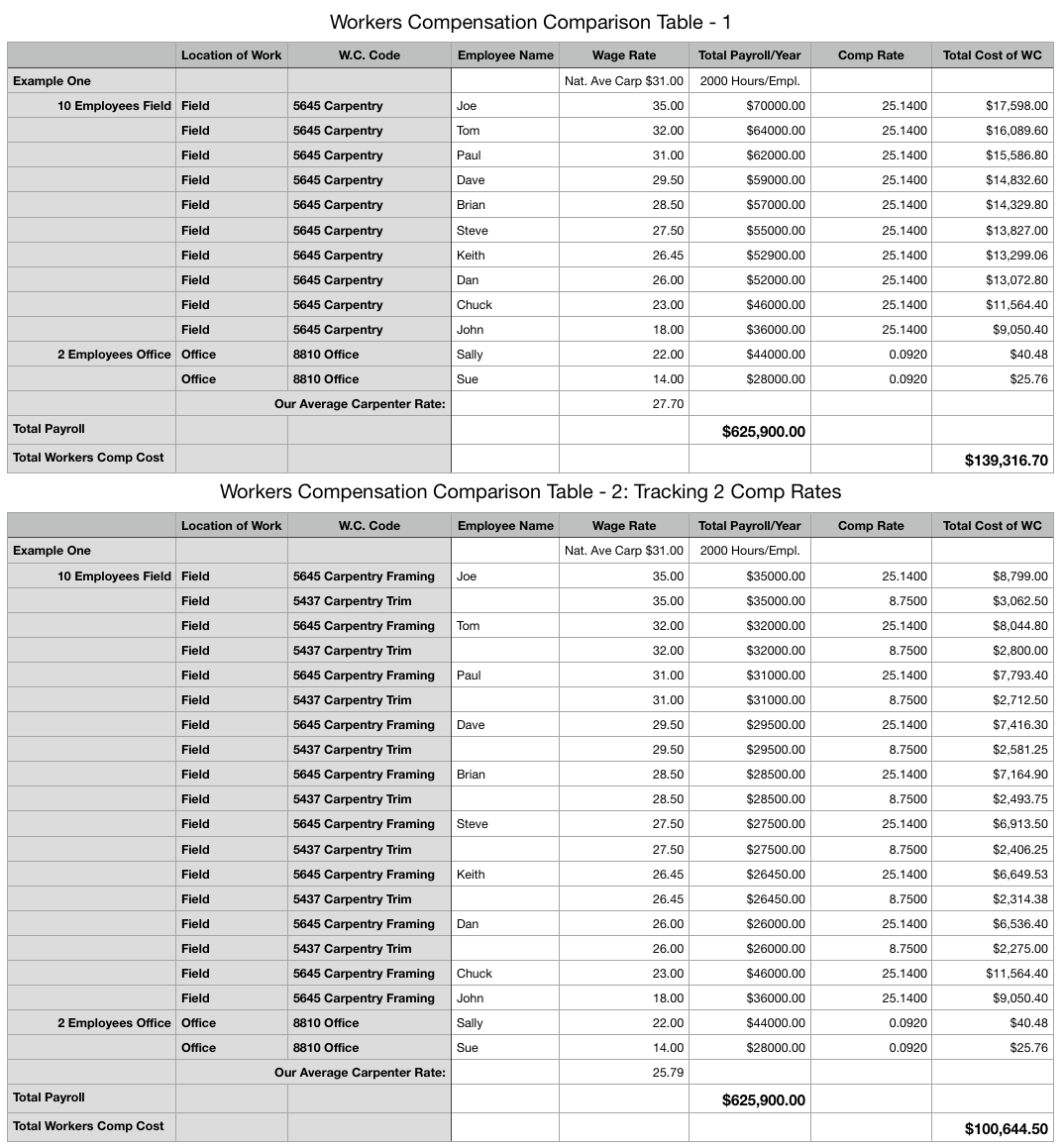

Just how much is Mecherath saving you over the cost of the software?

A Conservative Example:

Let’s assume half of your projects don’t have any structural framing; a different code could apply 5437 Carpentry Trim. In the second table, we added only one new code, 5437 Carpentry Trim, for 8 of the 10 people carpenters, for only half of their time.

Using only one different category for eight employees equals a difference of $38,705.20 in savings. Mecherath will cost you $11,988 for those 12 employees per year, a net savings to your company of $26,717.20 per year. Rates may differ with each state/code/rate.